You've Been Logged Out

For security reasons, we have logged you out of HDFC Bank NetBanking. We do this when you refresh/move back on the browser on any NetBanking page.

OK- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

-

content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/accounts.svg

Accounts

-

ThisPageDoesNotContainIcon

Savings Accounts

- How to Personalise Bank Account Number

- Family Savings Group Account

- Eligibility

- Documentation

- Fees & Charges

- Senior Citizens Savings Scheme Account

- Speciale Gold Women's Savings Account

- Fastag ACQ

- Women Savings Account Bengali

- Women Savings Account Hindi

- speciale-Senior-Citizen-savings-account

- Dc Offer Sept

- Regular Savings Account Tamil

- DigiSave Youth Account Bengali

- Savings Max Account Bengali

- Regular Savings Account Bengali

- Types Of Savings Accounts - Compare Savings Accounts Online

- Super Kids Savings Account

- ThisPageDoesNotCntainIcon Money Maximizer

- DigiSave Youth Account

- DigiSave Youth Account Hindi

- DigiSave Youth Account Tamil

- DigiSave Youth Account Marathi

- DigiSave Youth Account Telugu

- InstaAccount

- Insta Account Kannada

- Insta Account hindi

- Insta Account Bengali

- Insta Account Tamil

- Insta Account Marathi

- Insta Account Telugu

- Government Scheme Beneficiary Savings Account

- Speciale Gold and Speciale Platinum

- Specialé Activ Account

- Aadhaar Seeding Page

- Common Fees and Charges for Savings Account

- BSBDA - Basic Savings Bank Deposit Account

- Savings Farmers Account

- Institutional Savings Account

- Small Savings Account

- Digisave Youth Account Kannada

- DigiSave Youth Account Malayalam

- Regular Savings Accounts

- Regular Savings Accounts Hindi

- Regular Savings Account Mararthi

- Regular Savings Account Telugu

- Savings Max Account

- Savings Max Account Hindi

- Savings Max Account Tamil

- Savings Max Account Marathi

- Savings Max Account Telugu

- Women Savings Account

- Women Savings Account Tamil

- Women Savings Account Marathi

- Women Savings Account Telugu

- Kids Advantage Account

- Senior Citizen's Account

-

ThisPageDoesNotContainIcon

Salary Account

- Speciale Salary Account

- Salary Account

- Salary Account

- salary-accounts-hindi

- defence-salary-account-hindi

- regular-salary-account-hindi

- savings-bank-deposit-account-salary-hindi

- CSA Offers

- Corporate Salary Account IBM

- Corporate Salary Account Capgemini

- Corporate

- Corporate Salary Account

- Tax Season

- Save your taxes now to avoid last-minute panic

- Enjoy special offers for Government Personnel

- 7 Solutions to keep your Resolutions!

- Important information regarding your HDFC Bank Salary Account

- Wealth Create

- Wealth Protect

- Switch to Save

- Salary Family Account

- Anmol Salary Account

- Online Zero Balance Salary Account

- Reimbursement Account

- Veer Account

- Government Salary Account

- Regular Salary Account

- Premium Salary Account with Platinum Debit Card

- Salary benefits

- documentation-hindi

- Premium Salary Account with Millennia Debit Card

-

ThisPageDoesNotContainIcon

Current Accounts

- Regular Collection Account

- Biz Lite+ Account

- Biz Pro+ Account

- Premium Current Account

- Investments for CA customers

- Max Advantage Current Account

- Biz Ultra+ Account

- Biz Elite+ Account

- Ascent Current Account

- Activ Current Account

- Plus Current Account

- Regular Current Account

- Saksham Current Account

- Current Account For Professionals

- Agri Current Account

- Institutional Current Account

- RFC - Domestic Account

- Exchange Earners Foreign Currency (EEFC) Account

- Ultima Current Account

- Apex Current Account

- Max Current Account

- Supreme Current Account

- EZEE Current Account

- Trade Current Account

- Flexi Current Account

- Merchant Advantage Current Account

- Merchant Advantage Plus Current Account

- Current Account For Hospitals And Nursing Homes

- CSR Account

- vyapar-current-account

- RERA Current Account

- Startup Buildup

- e-Commerce Current Account

- Escrow Current Account Solutions

- Apply Online

- ThisPageDoesNotContainIcon Rural Accounts

- ThisPageDoesNotContainIcon PPF Account Online

- Garv Pension Saving Account

- ThisPageDoesNotContainIcon Savings Account Interest Rate

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/accounts.svg Merchant Services

-

ThisPageDoesNotContainIcon

Savings Accounts

-

content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/deposits.svg

Deposits

-

ThisPageDoesNotContainIcon

Fixed Deposit

- What is a Special Edition Fixed Deposit

- hdfc-bank-surecover-fd

- surecover-fixed-deposit

- terms-and-conditions

- eligibility

- surecover-fd-t-and-c

- Fixed Deposit

- Direct Deposit FD

- HDFC Bank HealthCover FD

- Goal Based Fixed Deposit Offer

- HealthCover Fixed Deposit

- Azadi Ka Amrit Mahotsav

- fd new year

- SweepIn Facility

- Overdraft against Fixed Deposits

- Regular Fixed Deposits

- Break Fixed Deposit

- Five Year Tax Saving Fixed Deposit

- FCNR Deposits

- Non Withdrawable Deposits

- Non withdrawal Deposits

- ThisPageDoesNotContainIcon Fixed Deposit Interest Rate

- ThisPageDoesNotContainIcon Recurring Deposit

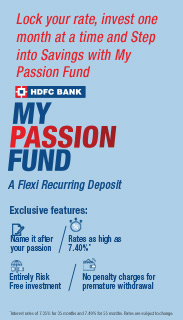

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/dream_deposit.svg My Passion Fund

-

ThisPageDoesNotContainIcon

Fixed Deposit

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/safe_deposit_locker.svg Safe Deposit locker

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/high_networth_banking.svg High Networth Banking

Open Fixed Deposit Offerring High Interest Rates and Guaranteed Returns

HDFC Bank Fixed Deposits and the interest on them are a good source of income – in a safe and assured manner. Choose a tenure and amount of your choice to grow your income in a steady fashion.

You can open an FD for as less as ₹ 5,000, and use it as a back-up for your savings or current account with Sweep-in and Super Saver Facilities. HDFC Bank Fixed Deposits easy and convenient to open or liquidate whenever necessary.

Grow income with compound interest on reinvesting principal and interest

Cover shortfalls in your account by sweeping in funds from linked FDs

Get an overdraft to tide over cash flow issues with the Super-Saver facility

For all Indians, HDFC Bank Ac not required

Attractive interest rates, assured returns

Fully digital, no paperwork

Min Fd amt: 5 lacs, Max FD amount: 2.99 cr

Flexi Tenure - Min tenure: 1 year, Max tenure: 10 years

Interest rates offered is same as Regular Fixed Deposit

Save tax under section 80c of the Income Tax Act

Invest a minimum of ₹ 100 upto ₹ 1.5 lakhs in a financial year

Enjoy quarterly or monthly interest pay outs

Hold your deposit in as many as six global currencies

Repatriate principal and interest amount fully

Enjoy tax exemption on the entire deposit

Link your current or savings account to a Fixed Deposit

Get an overdraft to tide over cash flow issues with such linking

Pay interest only on the overdrawn amount for the period it is used

Related Searches | |||

| fd calculator | fd interest rates | ||

| tax saving fd | fd full form | ||

| what is fd | best fd interest rates | ||

HDFC Bank Fixed Deposits provide a safe and efficient way to enhance your savings with assured returns. Our FD offerings come with attractive interest rates and a range of tenure options to fit your financial goals. With HDFC Bank, you can confidently invest your money knowing it is secure and poised for steady growth. Choose HDFC Bank Fixed Deposits to maximise your returns while preserving your capital.

Features and Benefits of HDFC Bank Fixed Deposits

- Attractive Interest Rates: HDFC Bank Fixed Deposits offer lucrative interest rates. This allows you to earn greater returns on your savings.y

- Flexible Tenure Options: HDFC Bank Fixed Deposits provide a range of tenure options. You can select a tenure that matches your financial plans. Interest rates can vary across different periods, catering to both short-term and long-term goals.

- Premature Withdrawal Facility: HDFC Bank allows premature withdrawals. Note that this option may come with a penalty, but it ensures liquidity in case of emergencies.

- Benefits for Senior Citizens: Senior citizens enjoy special benefits from HDFC Bank Fixed Deposits. Individuals above 60 years of age get higher interest rates.

- Customisable Interest Payout: Choose the interest payout frequency that best suits your financial needs. HDFC Bank offers flexibility with monthly, quarterly annual or cumulative interest payout options.

- Autorenewal Facility: HDFC Bank offers an autorenewal facility for bank Fixed Deposits. Your FD can be automatically renewed under the same terms. You can also provide specific renewal instructions to suit your needs, all at the prevailing interest rates.

- Nomination Facility: Secure your investment by appointing a nominee for your Fixed Deposit. You can do this at any time during its tenure. HDFC Bank allows you to update or change nominee details as needed.

- Loan Against FD: In times of financial need, you can use your Fixed Deposit as collateral to secure a loan from HDFC Bank. This way, you can address emergencies without breaking your FD and losing out on the benefits.

What Factors Should I Consider When Selecting a Fixed Deposit Account?

Here are the key factors you should consider:

- Interest Rates: Compare the rates offered by different banks to find the most suitable option. Higher interest rates mean better returns on your investment.

- Tenure: Fixed Deposits come with varying tenures. Choose a tenure that aligns with your financial goals and liquidity needs.

- Reinvestment Options: FD accounts offer the option to reinvest the interest earned, which can help in compounding your returns. Consider whether you want the interest to be paid out periodically (monthly, quarterly, annually) or reinvested until maturity.

- Premature Withdrawal: Life is unpredictable, you may need access to your funds before the FD matures. Check the terms and conditions for premature withdrawal, including any penalties or loss of interest.

- Special Schemes and Offers: Banks often roll out special schemes and promotional offers for Fixed Deposits, such as higher interest rates for senior citizens or tax-saving FDs. Explore these options to see if you qualify for any special benefits.

- Additional Features: Look for additional features that FD accounts might offer. For example, Loan against FD, nomination facilities and online account management.

- Customer Service: Good customer service can enhance your overall experience with the bank. Choose a bank that is known for its efficient customer service, both online and offline.

Interest Rates

Interest rates on Fixed Deposits vary based on the deposit amount, tenure and type. Additionally, non-withdrawable Fixed Deposits with amounts starting from ₹2 crore usually offer enhanced rates, reflecting their long-term, less liquid nature. Rates are set to reward larger and longer-term investments with better returns.

Click here to know more.

Saving Tax on Fixed Deposit

Consider the following options to save tax:

- Invest in Tax-Saving FDs: Choose tax-saving Fixed Deposits under Section 80C of the Income Tax Act to claim a deduction up to ₹1.5 lakh. These FDs have a five-year lock-in period.

- Plan Investments Across Years: Spread your FD investments to keep annual interest below the TDS threshold of ₹50,000 (₹1,00, 000 for senior citizens) to avoid TDS.

- Utilise Senior Citizen Benefits: Senior citizens benefit from higher TDS exemptions and additional interest rates, enhancing returns and reducing taxes.

Process of opening a Fixed Deposit

Opening a Fixed Deposit with HDFC Bank is convenient through multiple channels. You can use HDFC Bank’s NetBanking platform, Mobile Banking app or PayZapp to create your FD account. Simply log in, navigate to the Fixed Deposit section and follow the prompts to complete your application.

Non-HDFC Bank customers can open a Direct FD with us.

- Access the digital booking portal – click here.

- Select the tenure and amount that suits you best.

- Fill in the required information digitally.

- Ensure you successfully complete video KYC for identity verification.

- Confirm your booking and watch your savings grow.

Frequently Asked Questions (FAQs) on Fixed Deposits

What is a Fixed Deposit (FD)?

A Fixed Deposit (FD) is a financial instrument where you deposit a lump sum of money with a bank for a fixed period at a predetermined interest rate.

What is the minimum and maximum deposit amount for an FD?

The minimum deposit amount is ₹5,000. There is no specific maximum limit for an FD.

What is the tax on Fixed Deposit?

Interest earned on FDs is taxable. Tax Deducted at Source (TDS) is applicable if the interest exceeds ₹50,000 (₹1,00,000 for senior citizens) in a financial year

Why should I invest in Fixed Deposits?

Investing in bank Fixed Deposits offers assured returns and capital protection with minimal risk. It provides a stable and predictable way to grow your savings. FDs offer flexible tenure options and competitive interest rates.

How can I add a nominee for Fixed Deposit?

You can add a nominee when opening the FD account or update it later through NetBanking, visiting a branch or contacting customer service.

What is Sweep-in-facility?

The Sweep-in facility links your savings or current account with the FD. It enables the automatic transfer of funds from FD to the account when the balance falls below a certain threshold.

How safe is it to invest in FD?

Investing in an FD may be relatively safe because the returns are assured and know at the time of booking. Additionally, bank deposits are insured up to ₹5 Lakh by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Can I withdraw my Fixed Deposit before maturity?

You can withdraw your FD before maturity. However, a premature withdrawal penalty may apply. Please contact your RM in case you need to make premature withdrawals.

How many FDs can I Open?

You can open multiple FDs with HDFC Bank, as there is no limitation on the maximum number of FDs you can open.

Can I take a loan against my Fixed Deposit?

HDFC Bank offers loans against your FD. You can borrow up to 90% of the deposit amount without breaking the FD.

What are the interest frequency options for Fixed Deposits?

Interest can be received monthly, quarterly or at maturity, based on your preference.