You've Been Logged Out

For security reasons, we have logged you out of HDFC Bank NetBanking. We do this when you refresh/move back on the browser on any NetBanking page.

OK- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

-

content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/Money_Transfer.png

Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/cards.svg Cards

-

content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/bill_payment.svg

Bill Payments

- Smart Pay

- Merchant SI

- Biller Categories

- ThisPageDoesNotContainIcon Electricity Bill Payment

- ThisPageDoesNotContainIcon Mobile Post-Paid

- ThisPageDoesNotContainIcon Insurance Premium

- ThisPageDoesNotContainIcon Telephone-Landline

- ThisPageDoesNotContainIcon Gas

- ThisPageDoesNotContainIcon Water

- ThisPageDoesNotContainIcon Magazine Subscriptions

- ThisPageDoesNotContainIcon HDFC Bank Credit Card Bill Payment

- ThisPageDoesNotContainIcon Rent Payment

- ThisPageDoesNotContainIcon Club Membership

- ThisPageDoesNotContainIcon Other Bank Credit Card Bill

- ThisPageDoesNotContainIcon Mutual Fund Installment

- Visa Bill Pay

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/recharge.svg Recharge

-

content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/payment_solutions.svg

Payment Solutions

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/taxes.svg Taxes

- Payzapp

- FASTAG

- MyCards

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/cash_cheques_demand_drafts.svg Cash, cheque, Demand Draft

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/loan_repayment.svg Loan Repayment

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/educations_fees.svg Education Fees

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/donations.svg Donations

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/stay_secure.svg Stay Secure

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/payment_solutions.svg DirectPay

- content/bbp/repositories/723fb80a-2dde-42a3-9793-7ae1be57c87f?path=/Menu Icons/dream_deposit.svg PFMS_ePA

Business Credit Cards Online

As a business owner, you ought to have the right financial tools to elevate your business to new heights. At HDFC Bank, we realise this and offer a multitude of Business Credit Cards for your distinct financial needs. Our wide range of Business Credit Cards are designed to cater to a diverse range of businesses.

Explore a suite of financial flexibility, rewards and cashback, interest-free period, airport lounge access and more with our Business Credit Cards. Get access to Loans on Credit Cards to meet your immediate capital requirements or convert your high-value purchases into SmartEMIs for pocket-friendly repayments.

Up to 55 Days Interest Free Period

5X Reward Points on Bill Payments via PayZapp/SmartPay, Income Tax, GST & vendor payments via Swifti & SmartHub Vyapar, SmartBuy BizDeals

Unlimited Airport Lounge Access

6 Complimentary Golf games every quarter

Complimentary Annual membership of Club Marriott & Taj Stay Voucher worth ₹ 5000 on spends of ₹1.5 lakh within first 90 days as Welcome Benefit

Flight tickets / Taj Hotels Stay Voucher worth up to Rs.5,000 on every ₹ 5 Lakhs & above spends, Earn voucher worth ₹ 20,000 in calendar year as Milestone Benefit

5 Reward Points for every ₹ 150 spent (1 Reward Point = Up to ₹ 1)

24 X 7 Personal Concierge

Up to 55 Days Interest Free Period

5X Reward Points on Bill Payments via PayZapp/SmartPay, Income Tax, GST & vendor payments via Swifti & SmartHub Vyapar, SmartBuy BizDeals, Google Ads, Cleartax, Reliance Digital

Up to 16 domestic & 6 International Airport Lounge Access in a year

Complimentary Amazon Prime Annual Membership + BizPrime 6 months Subscription on completing 1 online transaction within 30 days as Welcome Benefit

MakeMyTrip / Reliance Digital Gift Voucher worth up to Rs.2,500 on per quarterly spends of Rs. 2.5 Lakhs as Milestone Benefit

4 Reward Points for every ₹ 150 spent (1 Reward Point = Up to ₹ 0.50)

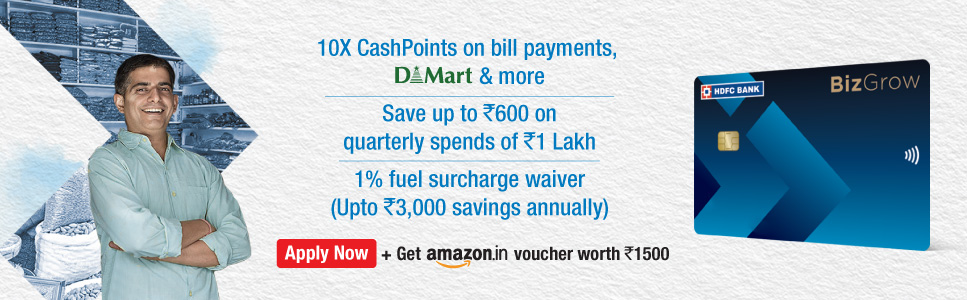

Up to 55 Days Interest Free Period

10X Cashpoints on Bill Payments via PayZapp / SmartPay, Income Tax, GST & vendor payments via Swifti & SmartHub Vyapar, SmartBuy BizDeals, Cleartax, DMart

Get 2000 Bonus Cashpoints on quarterly spends of ₹ 1 Lakh as Milestone Benefit. Earn up to 8,000 Cashpoints in a calendar year.

1% Fuel surcharge waiver

2 Cashpoints for every ₹ 150 spent

3% Cashpoints on EMI spends (Earn Maximum 1,000 Cashpoints/ month)

2% Cashpoints on Utility Bills, Electronics, SmartPay & PayZapp transactions (Earn Maximum 500 Cashpoints/ month)

1% Cashpoints on UPI and other spends (Earn Maximum 500 Cashpoints/ month)

Get 2000 Bonus Cashpoints on quarterly spends of ₹ 75,000 as Milestone Benefit. Earn up to 8,000 Cashpoints in a calendar year.

Up to 55 Days Interest Free Period

Up to 55 Days Interest Free Period

Avail 3X cashpoints on Business digital spends (Advertising, Accounting, Software license purchase, cloud hosting etc.), Bill payments via SmartPay & PayZapp, Income tax & GST payments, Travel benefits & software purchase via SmartBuy BizDeals.

Bonus 800 Cashpoints every month on monthly spends of Rs.50,000

1% fuel surcharge wavier

Exclusive discounts on specially curated range of products and services like 42 courses, LegalWiz, Harappa by Upgrad, Zoho, WeWork.

Up to 50 days interest free credit period

4 Reward Points for every Rs.150 spent on all online purchases

2 Reward Points for every Rs 150 spent on other expenses (Except fuel)

5% CashBack on Business Essential Spends like Electricity, Telephone & Internet bills, Government & Tax Payments

Upto 3% Unlimited Cashback everytime

Cash Advance Fee Reversal of Rs.500

Paytm First Membership - Upto 75k worth benefits

Upto 50 days of credit free period

Paytm HDFC Bank SELECT Business Credit CardBusiness Card

Upto 5% Unlimited Cashback everytime

12 Complimentary Airport Lounge Access

Paytm First Membership - Upto 75k worth benefits

Personal Accident Death Cover up to Rs.30 Lacs

Upto 50 days of credit free period

3% Cashpoints on Groceries, SuperMarket & Dining spends & all PayZapp transactions. (Maximum of 500 Points can be earned in a calendar month)

2% Cashpoints on Utility spends (Maximum of 500 Points can be earned in a calendar month)

1% Cashpoints on other spends (Excluding Rent, Wallet loads, EMI, Fuel & Education categories) (Maximum of 500 Points can be earned in a calendar month)

5% CashBack on Flipkart Wholesale Online Spends

5% CashBack on Telecom, Utility, Govt & Tax Payments up to Rs. 250 per month

1% CashBack on all other spends, no capping

Up to 50 days of interest free credit period

Enjoy 1% cashback on retail and international spends

Get free access to exclusive airport lounges when you travel

Stay protected with zero-liability on your card

Up to 50 days interest free credit period

4 Reward Points for every Rs.150 spent

Complimentary 6 International + 12 domestic airport lounge visits annually

5% CashBack on Business Essential Spends like Electricity, Telephone & Internet bills, Government & Tax Payments

Travel insurance cover up to Rs. 1 Cr

Up to 50 days interest free credit period

4 Reward Points for every Rs.150 spent on all online purchases

2 Reward Points for every Rs 150 spent on other expenses (Except fuel)

1% Fuel surcharge waiver

5% CashBack on Business Essential Spends like Electricity, Telephone & Internet bills, Government & Tax Payments

Business Credit Cards: How They Benefit Your Business

Propel your business forward with our range of Business Credit Cards. Know the benefits that await you:

- Financial Flexibility

Our Business Credit Cards are tailored to provide the financial flexibility to help you manage your everyday expenses and cover unwarranted costs.

- Expense Management

You can streamline your business finances with our Business Credit Cards by managing and analysing spendings.

- Customised Spending Limits

You can take control of your business expenses by setting personalised spending limits. You can do so by using HDFC Bank’s PayZapp, NetBanking, Mobile Banking and MyCards.

- Get Rewarded

Earn rewards with every business transaction. Whether it's cashback or reward points, our rewards programmes help add value to your business spending.

- Build Business Credit

Consistent and responsible use of our Business Credit Cards can contribute positively to your business credit score, opening doors to better financing options in the future.

- Travel Benefits

Businesses with frequent travel needs can enjoy travel-related perks such as airport lounge access, insurance, flight vouchers, etc., making business trips more cost-effective and enjoyable.

- Dining Benefits

You can enjoy attractive discounts on dining out via Swiggy Dineout with select HDFC Bank Business Credit Cards.

- Emergency Cash Access

Whether you're travelling abroad or facing unexpected expenses, our Business Credit Cards provide a safety net for urgent financial needs.

- Consolidated Payments

You can pay for all your business expenses for a particular period via a Credit Card bill payment. This makes it easier for you to track and manage your expenses.

Documents Required to Apply for a Business Credit Card

The following documents are required for the Business Credit Card application:

- Business owner’s ID and address proof

- Business address proof

- Business registration proof

- Bank statements

- Income proof of business

- Proof of business continuity

How to Use Your Business Credit Card Wisely

Make the most of your Business Credit Cards with these tips:

- Choose the Right Card for You

HDFC Bank offers a wide range of Business Credit Cards you can choose from. Select the one that closely meets your business needs; check the eligibility and annual charges.

- Set Spending Limits

Establish clear guidelines for card usage within your organisation. Define which expenses are allowed and set spending limits for employees if necessary.

- Track Transactions Regularly

Keep a close eye on your card transactions through HDFC Bank’s online banking channels to identify unauthorised or unusual transactions.

- Pay the Full Balance on Time

Avoid interest charges by paying your Credit Card bill in full before the due date. Ensure a positive credit history and avoid debt accumulation.

- Maximise Savings With Rewards

You can take advantage of reward points and cashback and save more on your spends. For instance, you can redeem your reward points into airmiles and get discounted airfare for business travel.

- Take Advantage of Interest-Free Period

Time your purchases after the Credit Card bill generation date to make use of the full interest-free period.

- Familiarise Yourself With the Card’s Terms and Charges

Read the terms and conditions of your Business Credit Card, including interest rates, fees, and any applicable penalties. Being cognizant of these details helps you avoid unexpected costs.

- Consider Automating Payments

Set up automatic payments to ensure that you never miss a due date. This way, you can avoid late payment fees and potential impact on credit score.

- Review Your Credit Report from Time to Time

Check your business credit report regularly to address any discrepancies promptly. Monitoring your credit helps you identify and correct any issues that may affect your creditworthiness.

FAQs

What is a Business Credit Card?

A Business Credit Card is a financial tool designed for business expenses. Like a regular Credit Card, you can make purchases and pay for those purchases later in the form of Credit Card bills. Business Credit Cards provide a convenient way for businesses to manage their expenses, make purchases, and separate business transactions from personal finances.

Who is eligible for a Business Credit Card?

Businesses, self-employed individuals, etc., can apply for a Business Credit Card provided they fulfil the card issuer’s eligibility criteria.

How to apply for a Business Credit Card?

You can apply for a Business Credit Card online on the card issuer’s website. For HDFC Bank’s Business Credit Card, you can get started here. Choose the Credit Card variant and fill out the online application form or connect with customer support.

What is the credit limit on a Business Credit Card?

The credit limit on a Business Credit Card can vary widely depending on several factors, including the financial health of the business, the business owner's credit history, and the card issuer's policies.

Can I use a Business Credit Card for personal expenses?

Typically, using a Business Credit Card for personal expenses is not recommended. For instance, combining personal and business expenses may make it difficult to report business-related expenses for tax purposes. Make sure you check the terms and conditions of your specific Credit Card agreement.

All About Business Credit Cards

Useful Credit Card Links

-

Active Channel Partners

-

Personal MITC

-

Purchase MITC

-

Corporate MITC

-

Credit Cards Policy

-

DSA code of conduct

-

Fair practices code

-

Transaction alerts

-

Statement Payment Related Info

-

Retail Card Member Agreement

-

Priority Pass

-

Corporate Card Member Agreement

-

Contactless Cards

-

Chip+PIN Credit Card

-

Co-Brand Credit Card Revenue Sharing Disclosure

-

Key Fact Statement- Purchase Card

-

Key Fact Statement- Corporate Card

-

Commercial Card-Membership Kit

-

MyRewards Program Terms & Conditions