You've Been Logged Out

For security reasons, we have logged you out of HDFC Bank NetBanking. We do this when you refresh/move back on the browser on any NetBanking page.

OK- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- Cards

- Bill Payments

- Recharge

- Payment Solutions

- Money Transfer

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Home

- PAY Cards, Bill Pay

- Money Transfer

- To Other Account

- To Own Account

- UPI (Instant Mobile Money Transfer)

- IMPS (Immediate Payment 24 * 7)

- RTGS (Available 24 * 7)

- NEFT (Available 24 * 7)

- RemitNow Foreign Outward Remittance

- Remittance (International Money Transfers )

- Religious Offering's & Donation

- Visa CardPay

- RemitNow (For Expat)

- Forex Services for students

- Pay your overseas education fees with Flywire

- ESOP Remittances

- SAVE Accounts, Deposits

- INVEST Bonds, Mutual Funds

- BORROW Loans, EMI

- INSURE Cover, Protect

- OFFERS Offers, Discounts

- My Mailbox

- My Profile

- Personal

- Resources

- Learning Centre

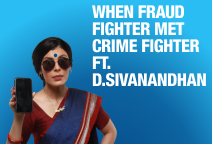

- Vigil Aunty

- What is Account Takeover Fraud Understanding

What is Account Takeover Fraud? Understanding and Preventing Bank Account Takeover

7 August, 2024

Synopsis

Account Takeover Fraud targets your bank accounts through unauthorised access.

In this, your account is drained of funds and used to make illegal purchases.

Using strong passwords and checking your accounts regularly can help you stay safe.

In today’s digital age, where financial transactions and personal data are increasingly managed online, security has become a paramount concern. One of the threats faced by individuals and businesses alike is Account Takeover (ATO) fraud. The rapid digitisation of financial services and the surge in online activity have made ATO fraud a growing concern. Read on to learn about ATO and how to safeguard yourself.

Definition Of Account Takeover Fraud

Account Take Over or ATO fraud occurs when a cybercriminal gains unauthorised access to your bank/financial accounts, through stolen credentials, phishing attacks, or exploiting security vulnerabilities. Once attackers gain control, they can manipulate the account for financial gain, steal sensitive information, and perpetrate further fraud.

The account takeover activity essentially entails attackers draining bank accounts, making unsanctioned purchases, or opening new credit accounts in your name.

What Are The Risks Of Account Takeover Fraud?

Following are some ways in which ATO fraud works:

Credential Theft

Cybercriminals obtain login information through phishing scams, fake emails, or websites that mimic legitimate services. Data breaches and malware are also used to capture keystrokes.Phishing Attacks

Deceptive emails or messages that appear to be from legitimate sources prompt you to provide your login details, often creating a sense of urgency about suspicious activity or the need to verify account information.Exploiting Security Vulnerabilities

Hackers exploit weak password policies, unpatched software, or poorly implemented security protocols on websites or applications to gain illegal access to your accounts.Social Engineering

Attackers can manipulate you into divulging confidential information by pretending to be someone with legitimate authority or urgency, convincing you to provide access to your accounts.

Financial Account Takeover

Financial account takeover targets banking and financial accounts:

- Bank Account Takeover: Cybercriminals transfer money, make purchases, or take out loans in your name, often unnoticed until substantial damage occurs.

- Credit Card Fraud: Attackers use stolen credentials to make illegal purchases, leading to significant financial losses.

- Digital Wallets and Payment Platforms: Popular digital wallets and UPI apps are targeted, allowing attackers to transfer funds or make purchases quickly before detection.

Online Account Takeover

The e-commerce sector is a significant target for account takeover fraud, where cybercriminals exploit customer accounts for the following:

Attackers use stolen credentials to access online shopping accounts, causing financial loss and resulting in disputes and chargebacks for merchants.

E-commerce accounts contain sensitive data like addresses and payment details, which cybercriminals use for identity theft, further fraud, or sales on the dark web.

Preventive Measures To Observe

You can take the following proactive steps to secure your accounts:

Use strong, unique passwords with a mix of letters, numbers, and special characters, and change them regularly.

Be cautious of unsolicited emails or messages requesting personal information. Verify the sender’s legitimacy before clicking on links or providing details.

Activate multi-factor authentication on all accounts to add extra security, making unauthorised access more difficult.

Monitor account activity regularly to quickly identify and report unsanctioned transactions. Set up account alerts for real-time notifications of suspicious activities.

Stay Vigilant And Prevent Bank Account Takeover Fraud

Account Takeover fraud is a significant threat, driven by the increasing digitisation of financial services and online activities. Understanding the mechanics of ATO fraud, recognising its impact, and implementing robust detection and preventive measures are crucial steps in combating this menace.

Join Vigil Army, where Vigil Aunty will decode various frauds and give people a heads-up on the dos and don’ts of combating frauds online. To join the Vigil Army, send ‘Hi’ to her via WhatsApp number: 7290030000.

*Disclaimer: Terms and conditions apply. The information provided in this article is generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances.